Lloyds Bank has breeched the fundamental Consumer Right of Choice

In trying to toe the line of one EU Directive, Lloyds Bank has in fact breeched a number of fundamental consumer rights. I feel like I’ve been subjected to banking apartheid.

As stated in a previous blog post, I have been a customer of Lloyds Bank for 25 years, and at the time of writing am still supposedly a Lloyds TSB Platinum Account holder. I signed up to Lloyds when I joined Aston University in 1988 - I believe there were 4 branches on campus - Barclays, Lloyds, Midland and NatWest. I unequivocally chose to sign up with Lloyds, and have been a good and loyal customer since then. The Aston University Branch was merged with the Lloyds Priory Branch some years later, and is now set to become a TSB outlet. I have lived in London for the last 15 years, and have used my local Lloyds Branch on Edgware Road - I have had no physical connection or contact with the Priory branch for nearly two decades.

This June, I was sent a letter from my bank - from a certain Catherine Kehoe (Director, Brands and Marketing) to inform me that my account had been one of those singled out to join TSB (on account of the Priory Branch switch). There were some other communiques about being able to request to stay with Lloyds.

I of course rang up immediately - informing my bank that I vehemently opposed the transfer of my account to another independent bank, and would like to stay with my original contracted bank - Lloyds. A return letter received on June 13th (ref AK273) confirmed my intentions to stay with Lloyds - and had some text including the header ’Staying with Lloyds TSB’. Over the last few months I have had a number of conversations with Lloyds personnel, who assured me that my request was being processed, and I would receive confirmation by the end of August. In the intervening weeks, I received several unsolicited calls from TSB - trying to sell me loans and other financial services. I informed said representatives that my intentions were to stay with Lloyds and they should surely have that recorded on their system somewhere.

In all my conversations with Lloyds personnel - never was it indicated that I could / would have no choice in any of these proceedings, that in fact my account would be moved automatically regardless of my personal choice or vehement opposition. Something I view as a unilateral unauthorised transfer of financial assets. It only became clear when we entered September that something decidedly distasteful was happening.

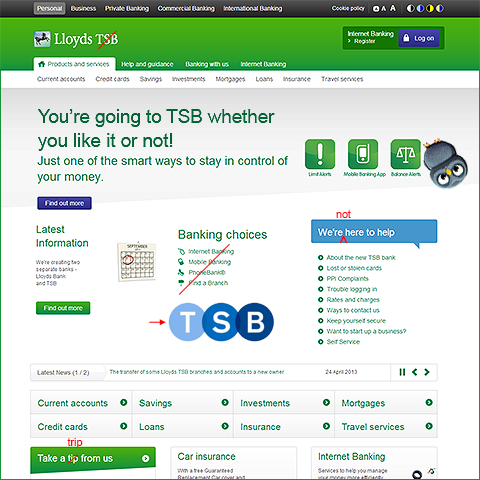

Without any of my say-so my Lloyds Platinum Account is being moved to the Temporary Sham Bank masquerading as TSB - a tiny, cut-down bank of 631 branches - with no sizeable assets and indeterminable liquidity. You just need to glance at their shoddy new website and cheap marketing materials to see how little thought has gone into the customer service part of this process. The bank offers no mission statement, no USP, and no modus operandi beyond being introduced to create more competition - when the truth is that this is a cast-off bank, solely created by Lloyds to meet an EU directive. The customers were never consulted, and their rights have been totally and absolutely breeched in every regard.

I phoned up this morning for one last attempt at resolving this situation, and ended up speaking with the usual army of ill-informed support staff, being passed from Deanne to Joseph to Debbie to finally Liam Donovan (New Account Opening Manager). He in essence told me the following:

- All Lloyds customers being moved to TSB really have no choice in the matter - it happens regardless of whether you’ve registered any sort of opposition to the change, and regardless of mitigating circumstances or actual local branch use

- Being a Platinum Account holder really affords you no special privileges - as Lloyds account holders you are all treated equally poorly

- If you want to stay with Lloyds - you actually need to open an entirely new Basic Account - which takes 28 days, and your existing account will move to TSB regardless - so you end up with 2 useless accounts

- You can only open basic / classic accounts with Lloyds for the next 30 days - irrespective of your status or financial standing

- You need to have your ’new’ Lloyds Basic account for at least 2 months before you can ’apply’ to have it upgraded back to your former Platinum Account Status - needless to say, current overdraft facilities etc. are waived also

- All your 25 years of banking / credit history account for nothing if you are considering opening / re-opening an account with Lloyds

I asked said Liam if he had any notion of customer service at all? And why could they simply not change my Sort Code digits to my local Edgware Road branch - which any normal bank in the world could accomplish within 24 hours. What became increasingly evident is that Lloyds has invented this process as a deterrent - to dissuade Lloyds account holders from even trying to maintain their existing financial status-quo.

In the irony of ironies I received a Welcome Pack from Temporary Sham Bank - ’Welcome back to local banking’ it says - offering me a branch which is half a mile further away than the branch I normally use.

In terms of any consumer charter, I know of no other company or institution which has so wilfully abused, misled and deceived its loyal customers. On another ironic note, this whole process was supposedly instituted under the guise of better consumer choice and service. Yet existing Lloyds account holders are being very obviously discriminated against. Following on from PPI and Libor, Lloyds has now really shown its true colours - it cares nothing for the likes of you and me, and is likely at any time to abuse and withdraw basic customer rights.

Everything Lloyds has done in this matter has been against its own loyal customers - I guess ’For the journey’ is a more apt slogan for the bank after all, it is far from ’The Thoroughbred Bank’ now. In most instances here - ’the journey’ is a euphemism from being taken for a ride.

I’ve still not really consoled myself with the fact that I’m being downgraded to TSB - another casualty of banking greed and woeful customer care. I don’t understand why the Financial Ombudsman or the Consumer Council or Which? even have not stepped up to the plate. I’ve lodged a complaint obviously - ref: 6618737 with Jay Parmar in the complaints department of Lloyds - no doubt that is on a special journey of its own.

I of course feel utterly betrayed and abused - having had an entirely new bank forced onto me, and after having every attempt at reconciliation rebuffed with a preventative measure. I cannot see now how anyone would want to bank with someone who does this to its most loyal customers?

As for the Temporary Sham Bank - you can see by the little investment Lloyds has put into this new bank launch that it’s been set up to fail - the government has been caught napping on this one again and will no doubt have to step in after a year or two. HSBC is looking mighty appealing now - it would be good to know what my fellow professionals recommend as the bank of choice ...

Did you find this content useful?

Thank you for your input

Thank you for your feedback

Upcoming and Former Events

Affino Innovation Briefing 2024

Webinar - Introduction to Affino's Expert AI Solutions - Session #2

Webinar - Introduction to Affino's Expert AI Solutions - Session #1

PPA Independent Publisher Conference and Awards 2023

Meetings:

Google Meet and Zoom

Venue:

Soho House, Soho Works +

Registered Office:

55 Bathurst Mews

London, UK

W2 2SB

© Affino 2024