The Disingenuous Nature of Many a Customer Loyalty Scheme

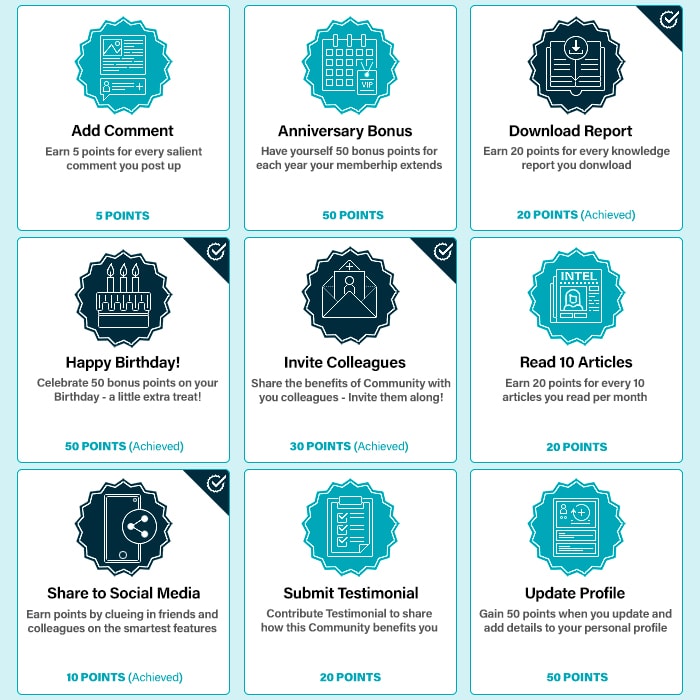

Loyalty points and tokens exist for a particular reason - they are there to reward regular customers, and help tie in and incentivise the less committed. When they work properly, they are always clearly and transparently to hand and can be called upon instantly to swing a purchasing decision in the right direction.

You see something above your usual budget ceiling - but look, you have saved up x number of points and now the bigger total does not seem so bad after all. Versus you may think you may have some loyalty points hidden away somewhere, but you’re not quite sure where, and they’re never at hand when you need them.

Most Brits are familiar with one of the very best loyalty schemes out there - the Boots loyalty points card, where you accumulate real monetary value points every time you make a transaction. Meaning at some stage you can reward yourself with a treat purchase. The mechanic is clear and simple to follow, yet not always 100% fully practical and useful, as it relies on a separate card system - which you must submit in addition to payment card. Far simpler a system that could recognise a customer code or name, which required no separate card other than payment card - to be activated. For Boots though, you pretty much always know where you stand and how to use your points - you just might not alwasy have the separate card handy.

Caffè Nero’s 10th cup free is an equally smart and simple scheme - collect a stamp every time you buy a coffee. Once you get to the magic number - the next coffee is on the house. Again relies on a separate card scheme, I am not a coffee drinker, but do love their hot chocolate - yet for a while I had several cards in circulation each with a few stamps. So - like the boots scheme, there are certain practicality reasons with maintaining separate card schemes, particularly with regard to how many different types of card a typical wallet has to accommodate.

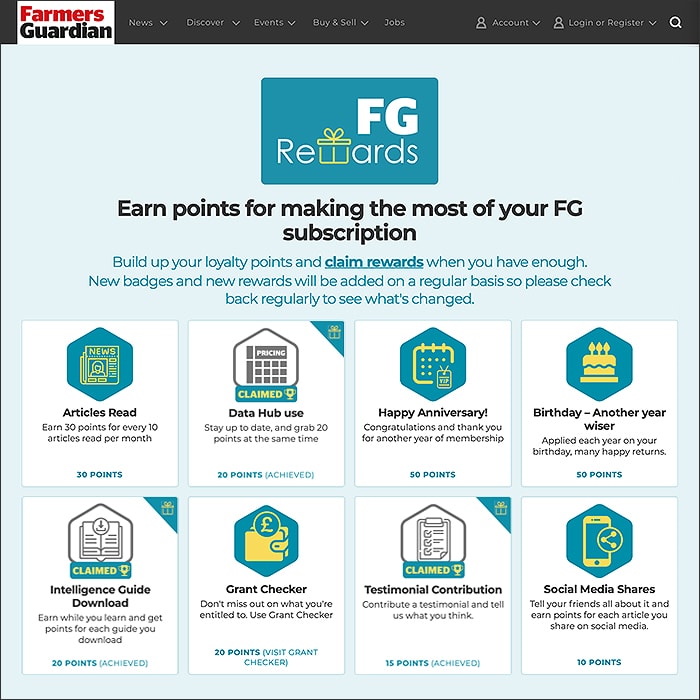

A better system still is the Andertons Music Co. loyalty scheme - whereby similar to Boots - you accumulate monetary value points every time you buy online. Better still - every time you checkout, you are told what your Points Balance is, and prompted as to if you want to use any of these towards your purchase. Some systems have limiting factors, i.e. you need to save a certain minimum amount, or that the amount must equal or exceed the total purchase price of goods - which is all nonsense really. A customer should be clearly and transparently rewarded for their loyalty, and their points should always be visible for easy deployment as they wish - this system encourages further purchases and means you are more likely to make additional sales.

Why then so many companies make it so hard for you to find, know and deploy your points. We have 3 differing examples in Amazon, HMV and Ocado. Let’s start with always online company Ocado - which could easily use a system like Andertons, but chooses to rather confuse and befuddle the customer by sending them loyalty points in an email - whereby you need to enter said very highly time-limited coupon code during checkout to get the benefit of the points.

If there’s a week between shops, you may forget you have points, and where you parked that email. You get to the checkout, and you are quite unable to recall the correct coupon code to get the loyalty points discount. Consumer psychology has shown that this is an atrocious system of consumer incentivisation - it is not there to reward the customer but to catch them out - so they forget the coupon code, and the vendor does not need to make good on its offer of discount. I know from my advertising days just how few coupons get redeemed - it’s kind of a cheat system which looks to confuse, befuddle and otherwise make consumers forget to deploy their well-earned loyalty points. I can appreciate a 12 month time limit for redemption, but that should be about the only limit. This is supposed to be a loyalty reward - and it’s a bit half-arsed really if you try spinning a load of dodgy terms and conditions into the process - it moves from being an incentive, towards becoming a disincentive or outright deterrent.

Time and time again, this approach has been shown to not work for the majority of consumers - many forget they had coupons / coupon codes stashed away, and more still don’t really have them to hand when they need to check out. Had they had them, they might very well have bought more, or bought a higher ticket item, but without the code, they may decide to forego the transaction entirely and nobody wins.

I have issues with Amazon, HMV and Ocado for all these reasons. Onsite on the main retail sites, none of them flag up that you have points in the bank as such, nor is there any easy way to find out if you do. HMV is particularly frustrating as you have to ’release’ the points on a separate loyalty card site, and you can only spend them in the physical store and not the online store. There are all kinds of useless not-good-value points awards like cheap signed merch and such - way over-valued, and in turn undervaluing the strength of the loyalty points - if not the whole scheme. Once you make it to a physical store, there is a further artificial £20 limit per transaction. So say you had £100 worth of loyalty point coupons, you would have to split it across 5 separate occasions. Frankly, the scheme is asinine and goes against all the precepts of consumer behavioural science.

Amazon is not as bad an offender as certain loyalty tokens are automatically prompted upton checkout, but you never really know what you’ve got saved up, or how and where you might deploy those.

If companies care about cultivating a proper loyalty scheme, and actually want to motivate customers to buy more, then they need to follow Boots’ and Andertons’ examples. For me you should always see what your loyalty points running total is, and should be able to deploy freely and instantly (with perhaps just a couple of well-explained exemptions) against any of your intended purchases, and up to the full points value of the points you have accrued. Putting in too many blockers and obstacles simply has the opposite effect and encourages undecided customers to shop elsewhere ...

Did you find this content useful?

Thank you for your input

Thank you for your feedback

Upcoming and Former Events

Affino Innovation Briefing 2024

Webinar - Introduction to Affino's Expert AI Solutions - Session #2

Webinar - Introduction to Affino's Expert AI Solutions - Session #1

PPA Independent Publisher Conference and Awards 2023

Meetings:

Google Meet and Zoom

Venue:

Soho House, Soho Works +

Registered Office:

55 Bathurst Mews

London, UK

W2 2SB

© Affino 2024