The Upper Tax Tribunal seems to have ruled that some Digital News Publications can be Zero Rated for VAT but the definitions are still far from 100% clear

News Corp has been involved in an ongoing case with the HMRC concerning tax liabilities and possible rebates in relation to the application and interpretation of the 1994 VAT Act - which defines how News Publications / Newsprint Editions are exempt from VAT. As this law came into being right at the start of the internet - it did not really properly or specifically target the arrival of Digital News Publications and Editions.

The lack of clarity in the legal definitions meant that the initial tribunal - or First Tier Tribunal ruled that while the Digital Editions could be construed as Newsprint Equivalents - they could not be fully defined as ’Newspapers’ by the existing terms and thus were not eligible for the Zero Rate of VAT - which seems to be one of the main qualifiers.

In the follow-up appeal at the Upper Tier Tribunal - News Corp lawyers won the ruling that essentially since the definitions and terms weren’t wholly clear - then the Digital Editions could not be entirely excluded from equivalency - and that the original VAT Act included terms for both Goods and Services - while the HMRC tried to separate Newspapers as strictly a solid product - and where the Digital Publications would be more associated with services. The ruling was granted on the conditions that the original VAT Act includes provisions for both Goods and Services - and thus the Digital News Editions can be rationalised within those terms.

The Tribunal delivered the following qualifiers for Digital vs Newsprint equivalency - which determine whether a Digital News Publication can indeed be covered by the Zero Rated VAT provision :

- Must be edition-based publications (not ‘rolling news’)

- The content must be fundamentally the same or very similar

- Any updates to the digital versions must be relatively minor

- Any additional content not provided in newsprint must be a relatively minor aspect of the digital editions

In line with other tax laws and statutes of limitations - the rebate period granted would be a maximum of 4 years - but would likely require individual evaluation and further definitions. In any case HRMC is reviewing the current ruling and will likely appeal once it has fully consulted legal counsel and extrapolated further definitions from the obviously rather inadequate and now quite archaic and anachronistic really.

As a publisher I would not necessarily be readying the Champagne quite yet - as this battle still has some rounds to go. Obviously what is needed here is an update to the law to specify with 100% clarity what the spirit of the original intentions were. News Media are going through a modern transition currently - and in these heavily politicised and often corrupt days - you could argue that proper News Services and Products are more important than ever before.

From my perspective I feel it’s still something of a wait and see.

Did you find this content useful?

Thank you for your input

Thank you for your feedback

Upcoming and Former Events

Affino Innovation Briefing 2024

Webinar - Introduction to Affino's Expert AI Solutions - Session #2

Webinar - Introduction to Affino's Expert AI Solutions - Session #1

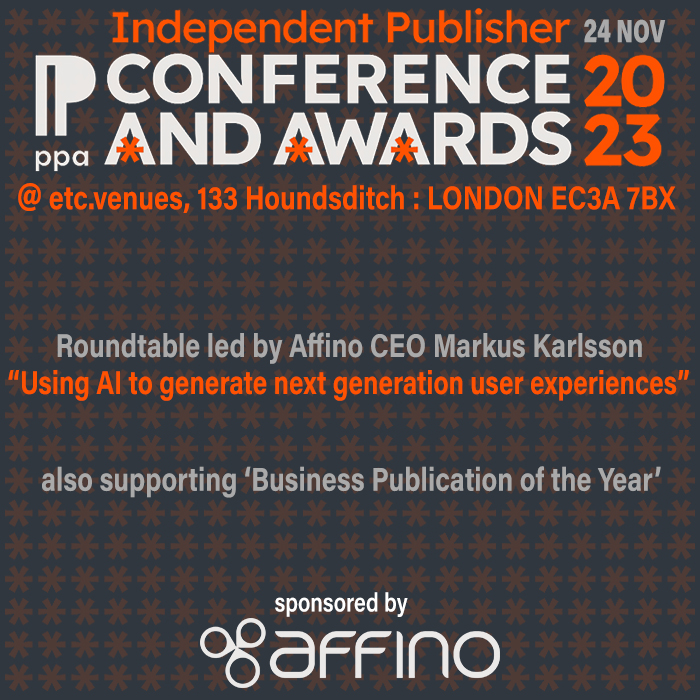

PPA Independent Publisher Conference and Awards 2023

Meetings:

Google Meet and Zoom

Venue:

Soho House, Soho Works +

Registered Office:

55 Bathurst Mews

London, UK

W2 2SB

© Affino 2024